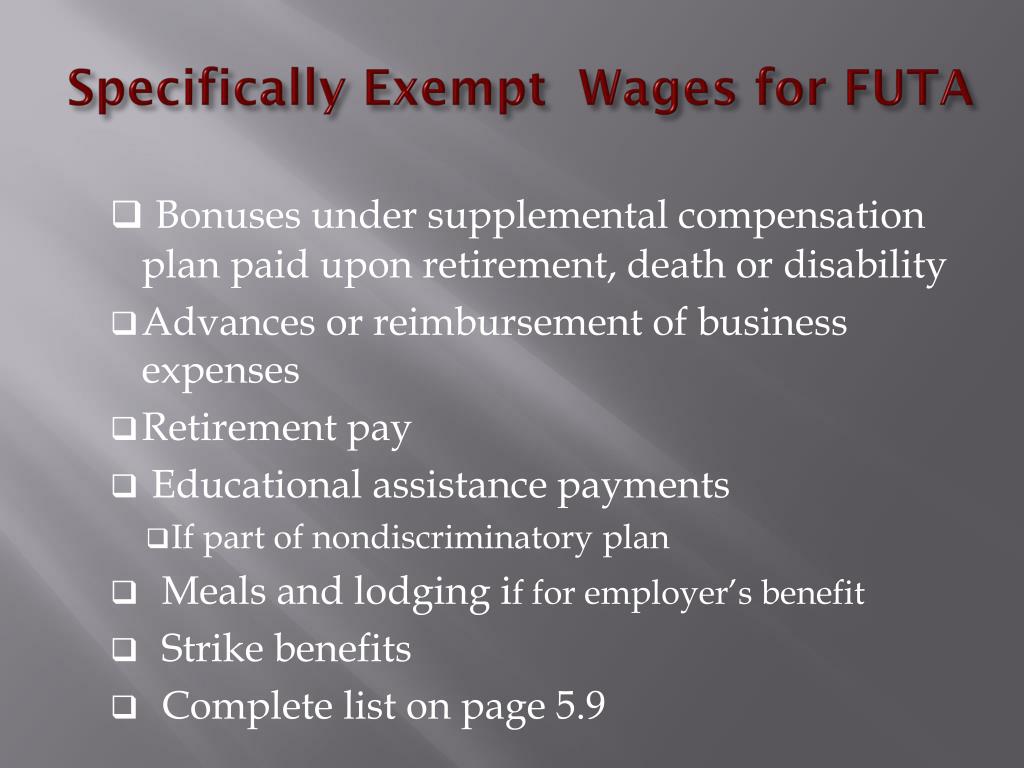

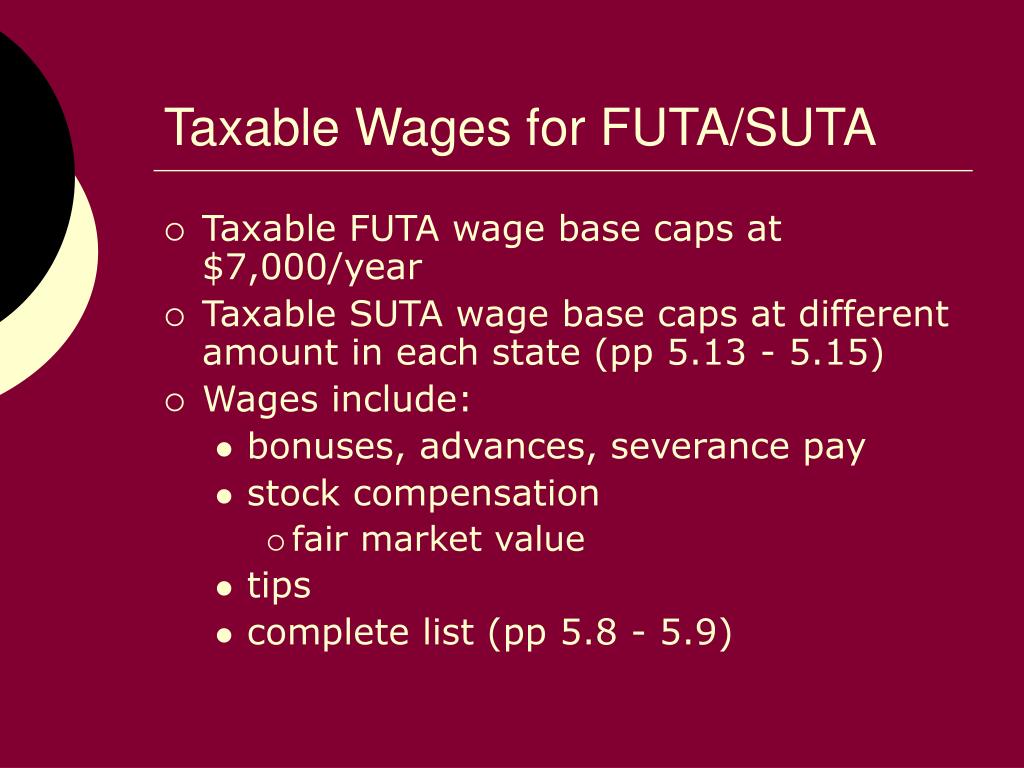

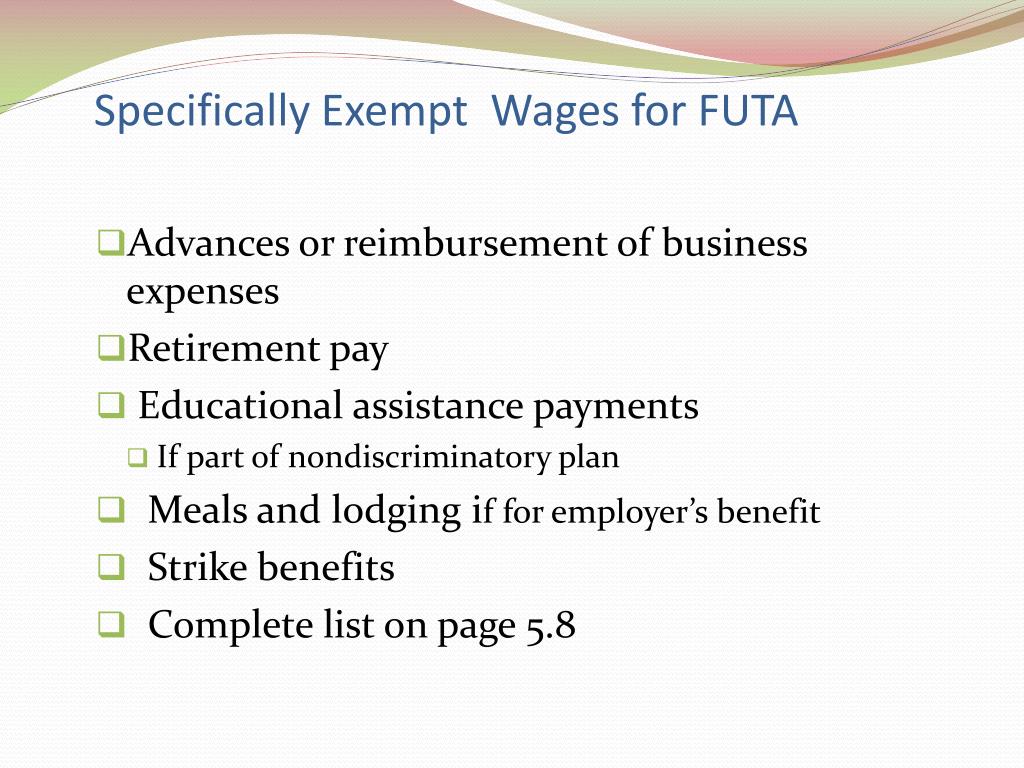

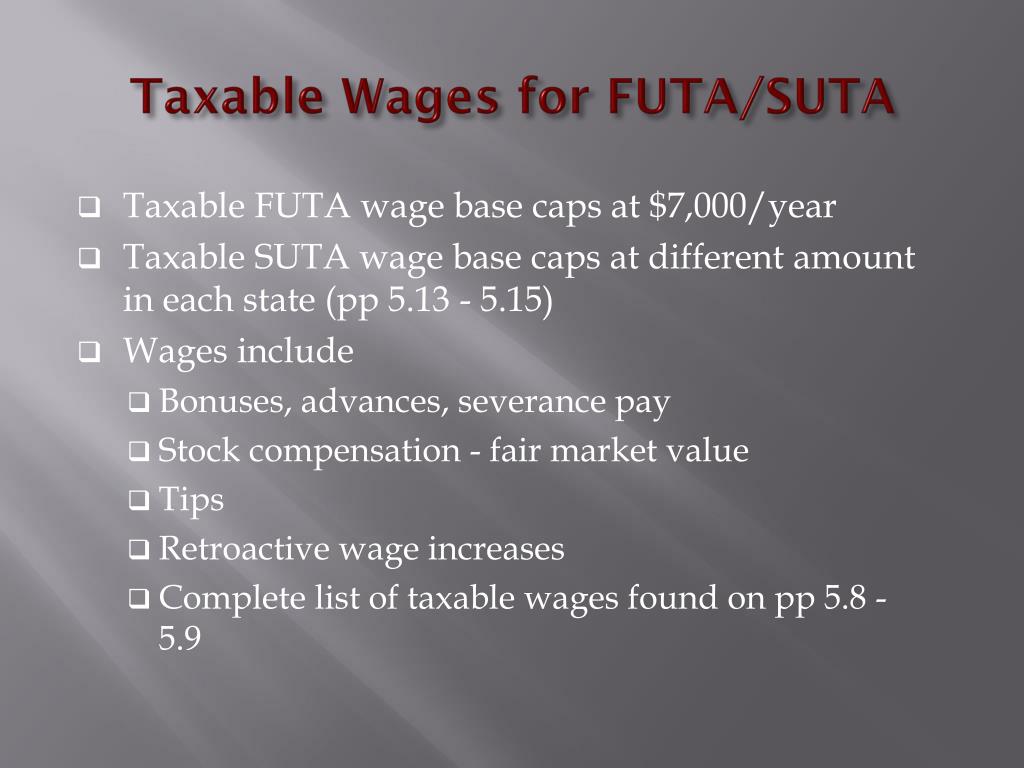

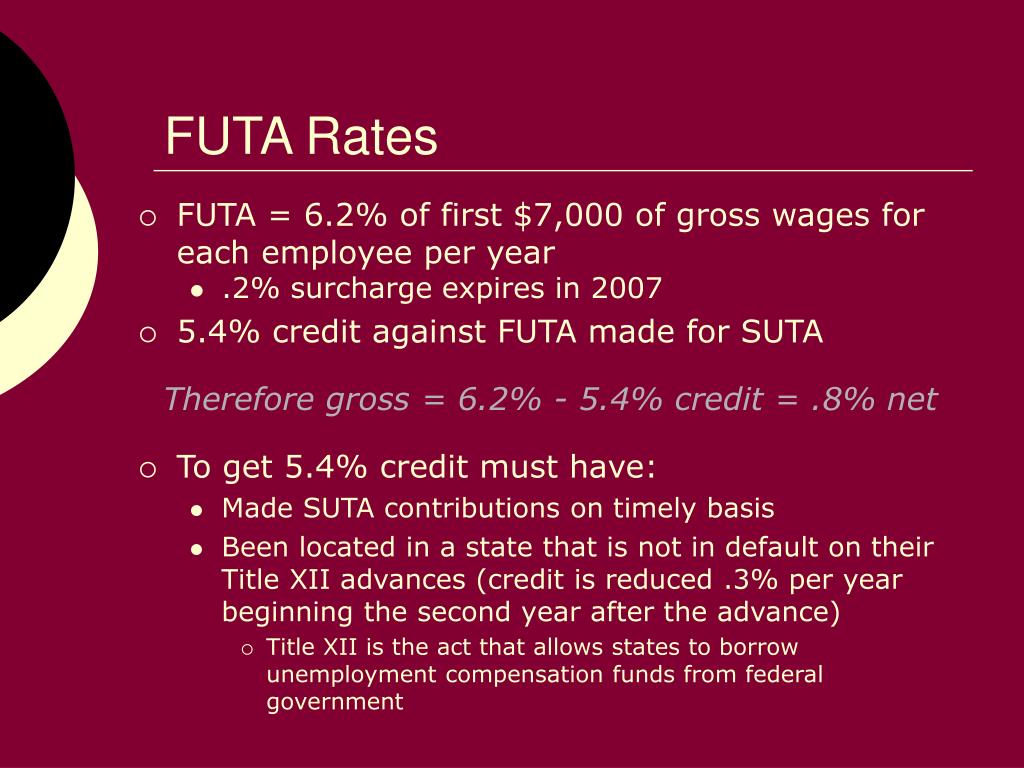

Futa Wage Base 2025. The federal unemployment tax act (futa) is a federal law that requires businesses to pay annually or quarterly to fund unemployment benefits for employees. Differential wage payments are wages for income tax withholding, but aren't subject to social security, medicare, or futa tax.

The federal unemployment tax act (futa) is a federal law that requires businesses to pay annually or quarterly to fund unemployment benefits for employees. For the suta wage base, it depends on your state.

PPT CHAPTER 5 PowerPoint Presentation, free download ID1650548, States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa). How to calculate and pay suta taxes.

PPT Unemployment Insurance PowerPoint Presentation, free download, States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa). States are required to maintain an sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa).

PPT CHAPTER 5 PowerPoint Presentation, free download ID6439756, Differential wage payments are wages for income tax withholding, but aren't subject to social security, medicare, or futa tax. Department of labor on november 10 announced that california, connecticut, illinois and new york will be subject to federal unemployment tax act.

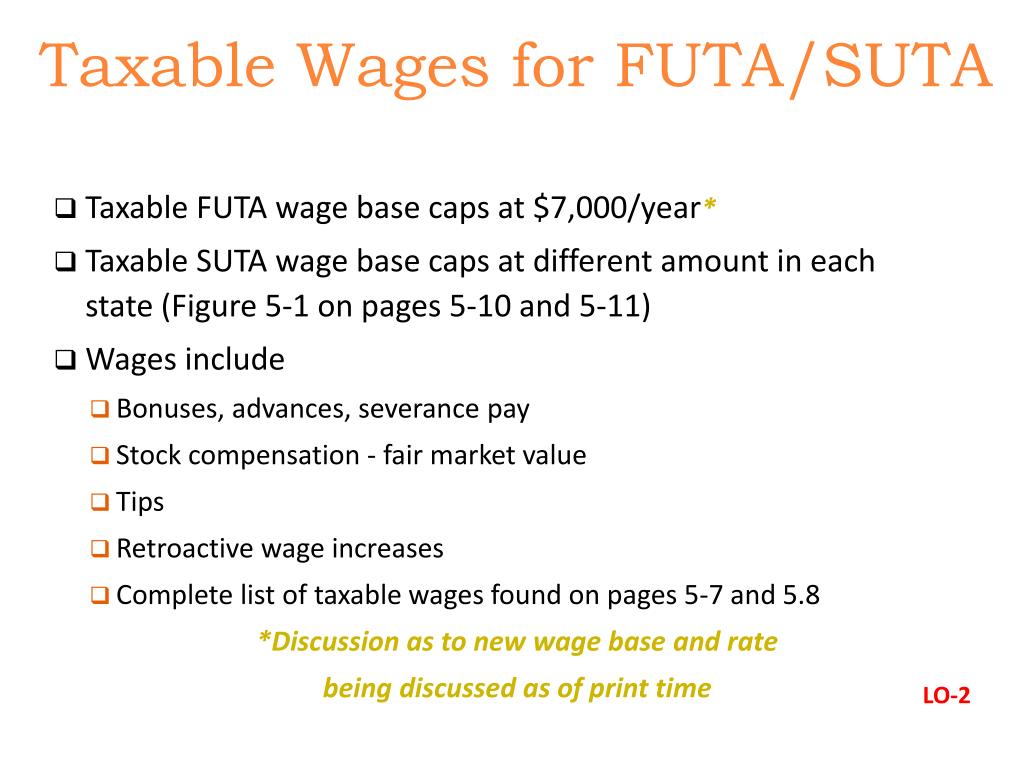

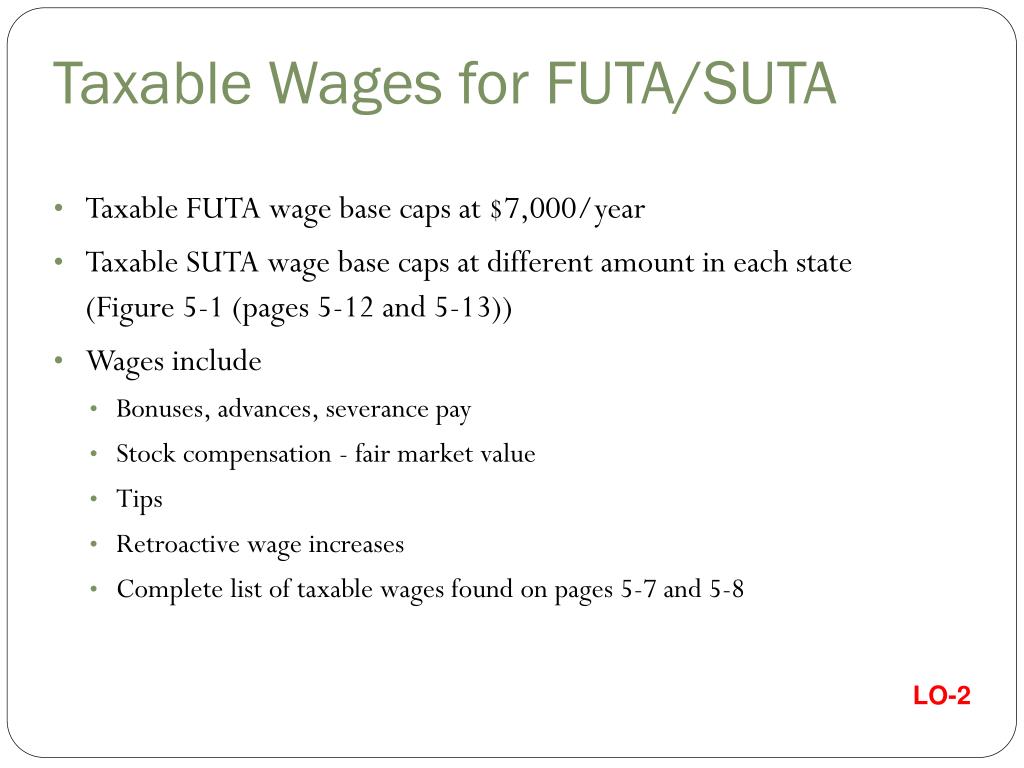

PPT CHAPTER 5 PowerPoint Presentation, free download ID7075332, It only applies to the first $7,000 they earned—this. How to calculate and pay suta taxes.

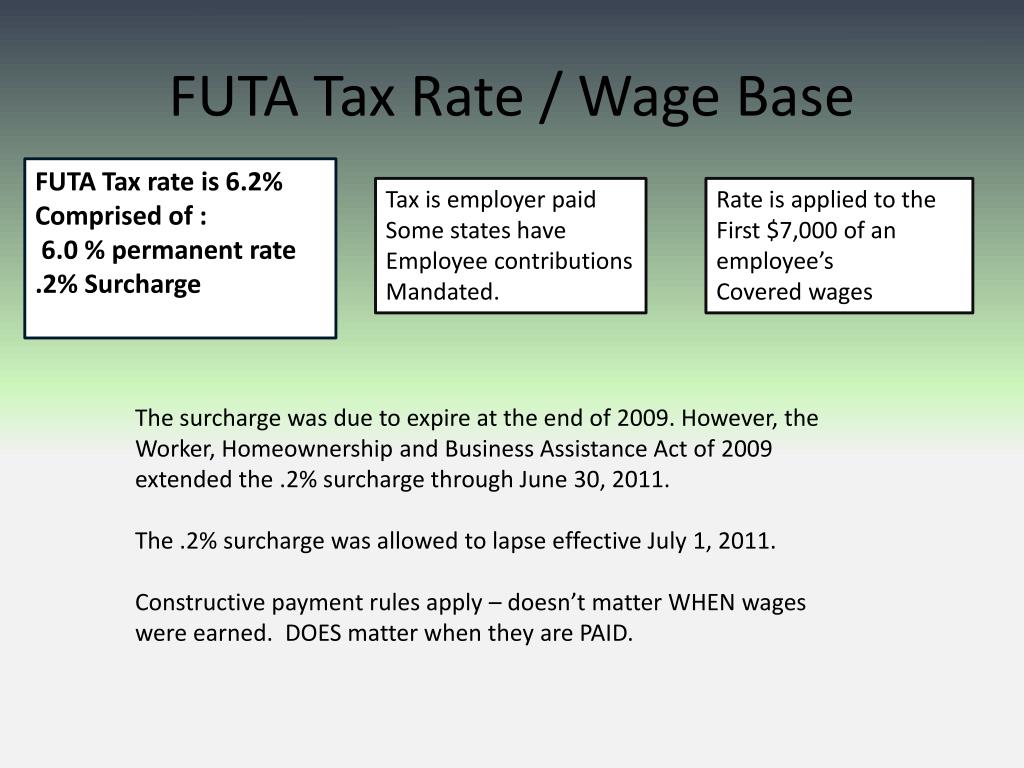

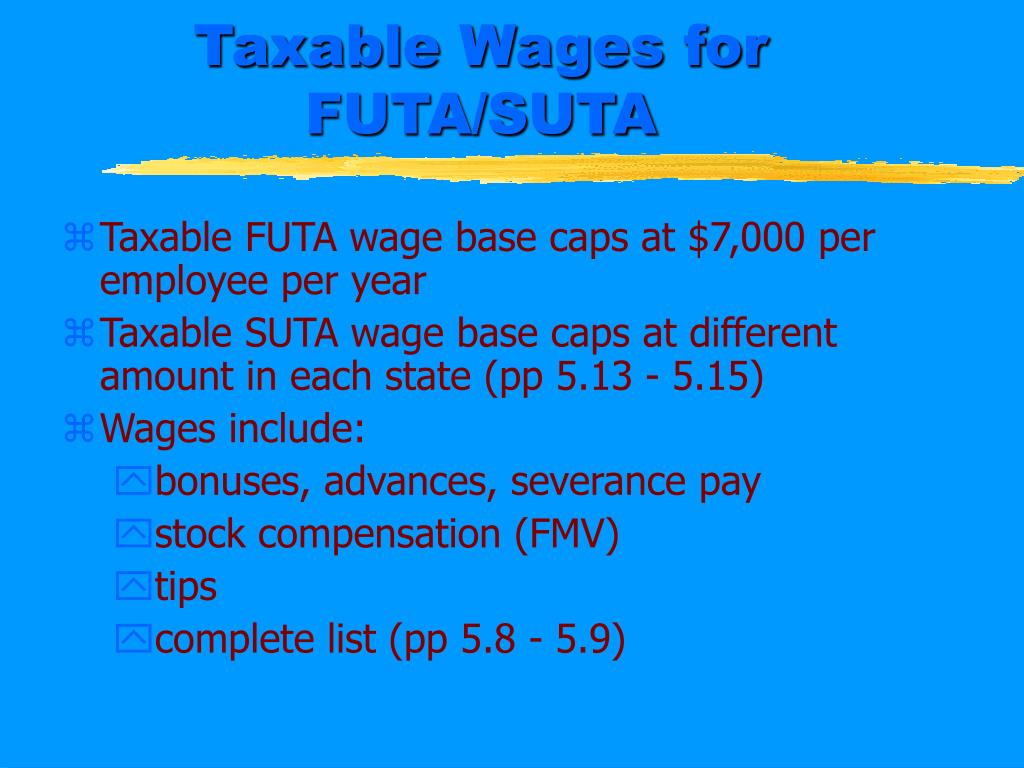

PPT CHAPTER 5 PowerPoint Presentation, free download ID1218115, The 2025 futa wage limit of $7,000 has. While the initial $7,000 is known as the “futa wage base,” a state unemployment tax act (suta) may modify this base.

PPT CHAPTER 5 PowerPoint Presentation, free download ID5969061, The amount of futa tax you pay is based on your company’s annual payroll. You will pay your futa tax rate on the first $7,000 that you pay each employee, per year.

PPT CHAPTER 5 PowerPoint Presentation, free download ID7075332, As for the wage base, we can check these irs articles about the futa rate: The futa tax rate is 6% of the first $7,000 paid to each employee annually.

PPT CHAPTER 5 PowerPoint Presentation, free download ID882618, The wage base is currently set at $7,000 per. To calculate your business’s futa tax liability, determine your employees’ wages subject to futa tax.

PPT CHAPTER 5 PowerPoint Presentation, free download ID4290683, How to calculate and pay suta taxes. Department of labor on november 10 announced that california, connecticut, illinois and new york will be subject to federal unemployment tax act.

PPT CHAPTER 5 PowerPoint Presentation, free download ID5969061, To calculate your business’s futa tax liability, determine your employees’ wages subject to futa tax. It only applies to the first $7,000 they earned—this.